Welcome to Capital Group

How To Stop Foreclosure in Florida

Find out the different laws to know when it is too late to stop foreclosure in Florida

Foreclosure Prevention Strategies Florida

Get Access to Private Home Buyers Who Buy Cash

We buy houses cash buyers is a proven last effort strategy that could stop foreclosure depending on the time to sell date.

Foreclosures Rules Florida

Homeowners Options

Capital Group offers cash to home sellers in foreclosures nationwide.

Learn All About The Foreclosure Process and How It Works in Florida

Florida Foreclosure Laws

How to Stop Foreclosure in Florida

Florida Foreclosure Facts

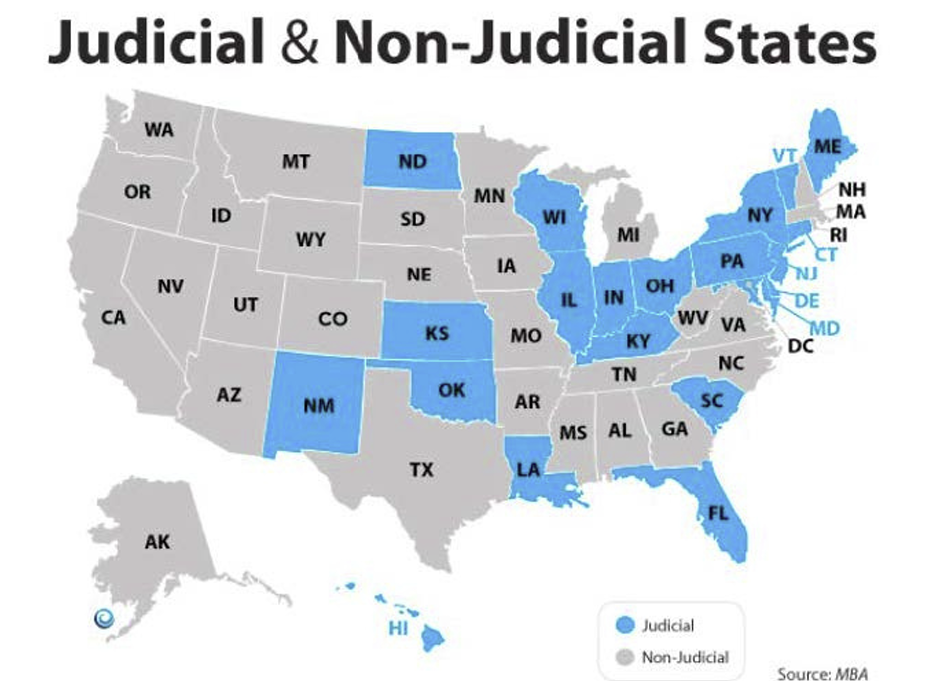

– Judicial Foreclosure Available: Yes

– Non-Judicial Foreclosure Available: No

– Primary Security Instruments: Mortgage

– Timeline: Typically 180 days

– Right of Redemption: Yes

– Deficiency Judgments Allowed: Yes

In Florida, all mortgages are foreclosed in equity. In a mortgage foreclosure action, the court severs, for separate trial, all counterclaims against the foreclosing lender. The foreclosure claim shall, if tried, be tried to the court without a jury.

The court order of foreclosure will specify how the foreclosure must take place, and the foreclosure must take place on those terms. Whenever a legal advertisement, publication, or notice relating to a foreclosure proceeding is required to be placed in a newspaper, it is the responsibility of the lender or their representative to place such advertisement, publication, or notice.

Equitable Right of Redemption ends at the foreclosure sale (or at another time specified by the courts, but this rarely happens). There is a period of time after the sale that “the court reviews the sale to ensure a fair price has been paid.” Basically, this period of time allows parties to object to the sale on the basis that proper procedures were not followed or collusion existed between the bidders, for example. This period is usually 10 days, after which the Certificate of Sale is filed and title passes, if the sale is confirmed. If the sale is not confirmed, another sale is ordered. (Reference F.S. Chapter 702)

The lender may sue to obtain a deficiency judgment in Florida.

How To Stop A Foreclosure?

1. Sell Your Home Speak with experienced real estate agents who are familiar with the home prices in your area so you can get an accurate market analysis. Although listing with a discount broker might sound like a reasonable way to save money, interview different agents and find one with strong marketing and sales experience. A discount broker will not save you money if they can’t sell the home before the foreclosure process ends.

2. Will Your Lender Consider a Short Sale If your home is worth less than what you owe on the loan, you might be a candidate for a short sale. Basically, your realtor will need to negotiate with the lender to see if they would be willing to take less than the full amount due on the loan. Keep in mind that this DOES affect your credit just as a foreclosure would and not all homes qualify for short sales.

3. Sign a Deed-in-Lieu of Foreclosure This essentially means the homeowner is signing the deed to the home back to the lender, thus closing out the loan and stopping foreclosure proceedings. Again, this affects one’s credit the same as a foreclosure would but you might even negotiate terms to stay in the home or rent the home for a lower price until the home is sold.

4. Chapter 13 Bankruptcy If these other avenues fail to stop the foreclosure, homeowners can file Chapter 13 bankruptcy which legally puts a stay on the foreclosure. At this point, all creditors are legally bound to stop their collection efforts, including selling the home in the foreclosure process. However, there are some exceptions and homeowners may still risk losing their homes but an attorney can help explain the legalities. Of course, if the lender won’t work with you and you’re unable to stay in the home…your options are a bit more limited… but there is still hope to save your credit rating, save you money, and get you out of your situation without hassle. We can evaluate your specific situation for you to lay it out in clear to understand terms exactly which options are realistic and exactly what each option can do for you and your family. Just get a hold of us and tell us a bit about your property… from there we’ll get back to you within 24 hours with a clear explanation of what will help you reach your goals in your specific situation.

The Foreclosure Process

The foreclosure process differs from state to state. Differences range from the notices that must be posted or

mailed, redemption periods, and the scheduling and notices issued regarding the auctioning of the property. In the

paragraphs that follow, you will find a outline of what to expect and how the process works along with a general

foreclosure timeline.

In general, mortgage companies start foreclosure processes about 3-6 months after the first missed mortgage

payment. Late fees are charged after 10-15 days, however, most mortgage companies recognize that homeowners

may be facing short-term financial hardships. Delinquent homeowners that stay in contact with their lender will

usually find that the lending institution is willing to work out some of the problems that they may be having.

Unfortunately, all too often, delinquent homeowners are embarrassed about what is happening and do not speak

with their lending institution until it is too late. After 30 days, the borrower is in default, and the foreclosure

processes begins to accelerate.

Three types of foreclosures may be initiated at the 30-day delinquent mark: judicial, power of sale, and strict

foreclosure. All types of foreclosure require public notices to be issued and all parties to be notified regarding the

proceedings. Once properties are sold through an auction, the former homeowner will have a small amount of time

to move out before the sheriff can issues an eviction.

High Return Investment Loans

Capital Group is excited to announce the High Yield 15% – 18% ROI for Real Estate Investment Notes that outperform REITs in Florida.

We’re the premier Lender for real estate investments. We believe you should be rewarded if you have a stronger investment and other components that offer less risk.

Investment Loans To Stop Foreclosure for Active Investors

As a real estate investor seeking higher return on investment deals you will need to find a private lender that will help you build your portfolio and who can close fast on more profitable real estate deals such as Capital Group.

Three Different Types of Foreclosures

Three types of foreclosures may be initiated at the 30-day delinquent mark: judicial, power of sale and strict

foreclosure. All types of foreclosure require public notices to be issued and all parties to be notified regarding

the proceedings. Once properties are sold through an auction, the former homeowner will have a small amount

of time to move out before the sheriff can issues an eviction.

1. Judicial Foreclosure. All states allow this type of foreclosure, and some require it. The lender files suit with

the judicial system, and the borrower will receive a note in the mail demanding payment. The borrower then

has 30 days to respond with a payment in order to avoid foreclosure. If a payment is not made after a certain

time period, the mortgaged property is then sold through an auction to the highest bidder, carried out by a local

court or sheriff’s office.

2. Power of Sale or Non-Judicial Foreclosure. This type of foreclosure, also known as statutory foreclosure,

is allowed by many states if the mortgage includes a power of sale clause. After a homeowner has defaulted

on mortgage payments, the lender sends out notices demanding payments. Once an established waiting

period has passed, the mortgage company, rather than local courts or sheriff’s office, carries out a public

auction. This normally takes place through a foreclosure trustee.

Non-judicial foreclosure auctions are often more expedient, though they may be subject to judicial review to

ensure the legality of the proceedings.

3. Strict Foreclosure. Two states, Connecticut and Vermont, allow this type of foreclosure. In strict

foreclosure proceedings, the lender files a lawsuit on the homeowner that has defaulted. If the borrower cannot

pay the mortgage within a specific timeline ordered by the court, the property goes directly back to the

mortgage holder. Generally, strict foreclosures take place only when the debt amount is greater than the value

of the property.

Judicial Foreclosure Process

What to Expect A judicial foreclosure is initiated with a lawsuit filed against the borrower, which typically includes a lis pendens and a demand for payment, as well as a request for a court order allowing you to sell the property.

The borrower is then served with a summons and given an opportunity to respond to the lawsuit.

If the borrower does not respond to the lawsuit or if the court rules your favor, the court will issue a judgment allowing you to sell the property to recoup the remaining balance of the mortgage.

The sale is typically conducted by a court-appointed auctioneer and the proceeds of the sale are used to pay off the outstanding debt, with any remaining funds going to the borrower.

Non-Judicial Foreclosure Process

What to Expect A notice of default and a notice of sale is sent to the borrower.

The borrower has a specified period to cure the default or to contest the foreclosure, after which you can proceed with the sale of the property. The sale is typically conducted by a trustee, rather than through a court proceeding.

You will need to rely on attorneys to help navigate the foreclosure process.

An attorney can assist you with drafting and filing the necessary legal documents, and advising you on compliance with state and federal laws regarding foreclosure.

The Foreclosure Process

Judicial Foreclosure Process

Uses State court system during foreclosure.

Homeowner carries the deed.

Default recorded at county courthouse.

Bank/Lender must go through courts before foreclosure can be initiated.

Court verifies default status, sends homeowner Lis Pendens notice.

In most states, the homeowner has 60 days at this stage in the process before home is sold at auction.

Non-Judicial Process

Uses Trustee to process foreclosure; courts not required.

Beneficiary (investor) carries the deed.

Default recorded at county Recorder's office.

Bank/Lender does not have to go through courts to initiate foreclosure process.

Trustee notifies owner of legal action through Notice of Default followed by Notice of Trustee Sale notification.

In most states, homeowner has 22 - 30 days at this stage in the process before home is sold at public auction.

State Foreclosure Laws and Timelines To Stop Foreclosure

| State | Judicial | Non-Judicial | Foreclosure Timeline | Redemption Period | Deficiency Judgement | State Website Laws |

|---|---|---|---|---|---|---|

| Alabama | X | X | 1 - 3 Months | Up to 12 Months | Yes (Judicial) | Stop Foreclosure Alabama |

| Alaska | X | X | 3 - 4 Months | None | Yes (Judicial) | |

| Arizona | X | X | 3 - 4 Months | Up to 6 Months | Yes (Judicial) | |

| Arkansas | X | X | 4 - 5 Months | Up to 12 Months | Yes | |

| California | X | X | 3 - 5 Months | Not Likely | Yes (Judicial) | |

| Colorado | X | X | 2 - 5 Months | None | Yes | |

| Connecticut | X | 5 - 6 Months | Court Determined | Yes | ||

| Delaware | X | 3 - 7 Months | None | Yes | ||

| District of Columbia | X | 2 - 4 Months | None | Yes | ||

| Florida | X | 4 - 6 Months | Yes | Yes | Stop Foreclosure Florida | |

| Georgia | X | X | 2 - 3 Months | None | Yes | Stop Foreclosure Georgia |

| Hawaii | X | X | 3 - 4 Months | None | Yes | |

| Idaho | X | X | 5 - 6 Months | None | Yes | |

| Illinois | X | 7 - 10 Months | Yes 3 -7 Months | Yes | ||

| Indiana | X | 5 - 7 Months | None | Yes | ||

| Iowa | X | X | 5 - 6 Months | 12 Months | Yes | |

| Kansas | X | 3 - 5 Months | Up to 12 Months | Yes | ||

| Louisiana | X | 2 - 6 Months | None | Yes | ||

| Maine | X | 6 - 10 Months | 90 Days | Yes | ||

| Maryland | X | 2 - 3 Months | Court Determined | Yes | ||

| Massachusetts | X | 3 - 4 Months | None | Yes | ||

| Michigan | X | 2 - 3 Months | Up to 12 Months | Yes | ||

| Minnesota | X | X | 2 - 3 Months | 6 Months | Yes (Judicial) | |

| Mississippi | X | X | 2 - 3 Months | None | Yes | |

| Missouri | X | X | 2 - 3 Months | Up to 12 Months | Yes | |

| Montana | X | X | 4 - 6 Months | 12 Months | Yes (Judicial) | |

| Nebraska | X | 5 - 6 Months | None | Yes | ||

| Nevada | X | X | 3 - 5 Months | None | Yes | |

| New Hampshire | X | 2 - 3 Months | None | Yes | ||

| New Jersey | X | 3 - 10 Months | 6 Months | Yes | ||

| New Mexico | X | 4 - 6 Months | 9 Months | Yes | ||

| New York | X | 4 - 8 Months | None | Yes | ||

| North Carolina | X | X | 2 - 4 Months | 10 Days | Yes (Judicial) | Stop Foreclosure North Carolina |

| North Dakota | X | 3 - 5 Months | 60 Days | No | ||

| Ohio | X | 5 - 7 Months | Until Confirmation | Yes | ||

| Oklahoma | X | X | 4 - 7 Months | Until Confirmation | Yes | |

| Oregon | X | X | 4 - 6 Months | None | No | |

| Pennsylvania | X | 3 - 9 Months | None | Yes | ||

| Rhode Island | X | X | 2 - 3 Months | Up to 3 Years | Yes | |

| South Carolina | X | 4 - 7 Months | None | Yes | ||

| South Dakota | X | X | 6 - 9 Months | Up to 12 Months | Yes | |

| Tennessee | X | 2 - 3 Months | Up to 2 Years | Yes | ||

| Texas | X | X | 2 - 3 Months | None | Yes | |

| Utah | 4 - 5 Months | 180 Days | Yes | |||

| Vermont | X | 7 - 10 Months | Up to 6 Months | Yes | ||

| Virginia | X | X | 2 - 3 Months | None | Yes | |

| Washington | X | X | 4 - 5 Months | 8 or 12 Months (Judicial) | Yes (Judicial) | |

| West Virginia | X | 2 - 3 Months | None | Yes | ||

| Wisconsin | X | X | 6 - 10 Months | None | Yes | |

| Wyoming | X | X | 2 - 3 Months | 3 Months | Yes | |

The Pre Foreclosure Notice Process Up to Foreclosure Auction Sale: Do You Have Time?

Timeline varies by state. Navigate the foreclosure process, discover all of your options, find the solution or solutions that may help you stop or avoid your foreclosure, and gain control over your foreclosure situation from here on out.

- First month missed payment – your lender will contact you by letter or phone. A mortgage housing counselor can help.

- Second month missed payment – your lender is likely to begin calling you to discuss why you have not made your payments. It is important that you take their phone calls. Talk to your lender and explain your situation and what you are trying to do to resolve it. At this time, you still may be able to make one payment to prevent yourself from falling three months behind. A mortgage housing counselor can help.

- Third month missed payment after the third payment is missed, you will receive a letter from your lender stating the amount you are delinquent, and that you have 30 days to bring your mortgage current. This is called a “Demand Letter” or “Notice to Accelerate.” If you do not pay the specified amount or make some type of arrangements by the given date, the lender may begin foreclosure proceedings. They are unlikely to accept less than the total due without arrangements being made if you receive this letter. You still have time to work something out with your lender. A cash house buyer investor can still help.

- Fourth month missed payment – now you are nearing the end of time allowed in your Demand or Notice to Accelerate Letter. When the 30 days ends, if you have not paid the full amount or worked our arrangements you will be referred to your lender’s attorneys. You will incur all attorney fees as part of your delinquency. A cash house buyer can still help you possibly.

- Sheriff’s or Public Trustee’s Sale – the attorney will schedule a Sale. This is the actual day of foreclosure. You may be notified of the date by mail, a notice is taped to your door, and the sale may be advertised in a local paper. The time between the Demand or Notice to Accelerate Letter and the actual Sale varies by state. In some states it can be as quick as 2-3 months. This is not the move-out date, but the end is near. You have until the date of sale to make arrangements with your lender, or pay the total amount owed, including attorney fees.

- Redemption Period – after the sale date, you may enter a redemption period. You will be notified of your time frame on the same notice that your state uses for your Sheriff’s or Public Trustee’s Sale.

Important: Stay in contact with your lender, and get assistance as early as possible. All dates are estimated and vary according to your state and your mortgage company.

Serving Real Estate Investors & Business Owners

Business Industries

Countries

Get Started

Find The Private Money For Real Estate & Business

Rehab Fix & Flip Loans

Fix and Flip loans are short-term, small-business loans that real estate investors utilize to purchase and renovate investment properties for resale that we like to call After Repair Value (ARV) which is a force appreciation strategy.

Bridge Loans & Term Loans

Bridge Loans are short-term financing investment loans which are used until the investor secures permanent financing and it’s mostly used for immediate cash flow to acquire the real estate assets. Some investors exit strategy is to sell.

Ground-UP Construction Loans

Ground-Up construction loans typically have project costs and need cash reserves. Development experience is required. We offer programs for a single home or an entire development.

Business Financing

We offer Business Loans with a variety of business financing programs that will get you the funding for your business. We offer over loans from $5,000 – $100 Million.

Foreclosure Timeline

How to Stop a Foreclosure Before It’s too late in Florida

Facing foreclosure can be an overwhelming experience for any homeowner. Understanding your options and acting quickly can make a significant difference. This article will guide you through various strategies to stop a foreclosure, using specific keywords to address all aspects of this challenging situation.

Understanding Foreclosure Types

- Tax Lien Foreclosure: This occurs when unpaid property taxes lead the local government to place a lien on your property, eventually resulting in foreclosure if not addressed.

- Mortgage Foreclosure: This is the process initiated by your mortgage lender when you default on your mortgage payments.

- Real Estate Tax Lien Foreclosure: Similar to tax lien foreclosure, this involves unpaid real estate property taxes leading to foreclosure.

- Property Tax Lien Foreclosure: When property taxes remain unpaid, this can trigger a lien and subsequent foreclosure.

- Property Mortgage Foreclosure: This is specifically related to defaulting on mortgage payments for a property.

- Real Estate Mortgage Foreclosure: A broader term encompassing foreclosure due to mortgage defaults on real estate properties.

Immediate Steps to Stop Foreclosure

- Contact Your Mortgage Company: If you are facing foreclosure, the first step is to contact your mortgage company. They may offer solutions like a payment plan or loan modification.

- File for Bankruptcy: Filing for Chapter 13 bankruptcy can provide an automatic stay, halting the foreclosure process and allowing you to reorganize your debts.

- Seek a Free Consultation with a Law Firm: A real estate law firm or investment property law firm can provide legal advice on how to stop foreclosure and may offer a free consultation.

Legal and Financial Considerations

- Legal Fees and Marketing Fees: Be prepared for potential legal and marketing fees when dealing with foreclosure. A law firm can help outline these costs.

- Stop Foreclosure Auction: If your property is set for a foreclosure auction, acting quickly to stop the foreclosure auction is crucial.

- Delinquency Notice: Respond promptly to any delinquency notice from your mortgage lender to explore your options.

- Late Fees and Back Payments: Addressing late fees and back payments can help stop the foreclosure process.

Strategies to Prevent Foreclosure

- Payment Plan: Setting up a payment plan with your mortgage lender can help you catch up on missed payments.

- Borrowing Money: Borrowing money from family, friends, or a financial institution can help you cover overdue payments.

- Selling Your Home: Selling your home before the foreclosure date can help you pay off the mortgage and avoid foreclosure.

- Redemption Period: Some states offer a redemption period after the foreclosure sale, allowing you to reclaim your property by paying the full amount owed.

- Short Sale: Negotiating a short sale with your lender can prevent foreclosure by selling the property for less than the mortgage balance.

Understanding State Laws and Procedures

- Non-Judicial Foreclosure States: In these states, the foreclosure process does not require court approval, making it faster and more streamlined.

- Court System and Default Judgment: In judicial foreclosure states, the lender must go through the court system to get a default judgment to proceed with foreclosure.

- State Law: State laws vary widely, so understanding the specific foreclosure laws in your state is essential.

Avoiding Foreclosure in the Future

- Keep Up with Mortgage Payments: Ensuring timely mortgage payments is the best way to avoid foreclosure.

- Manage Property Taxes: Stay current on your real estate property taxes and property taxes to prevent tax lien foreclosure.

- Regular Communication with Your Lender: Keep an open line of communication with your mortgage lender to address any financial difficulties early on.

- Explore Government Assistance Programs: There are various government programs designed to help homeowners facing foreclosure.

Conclusion

Stopping foreclosure requires immediate action and a clear understanding of your options. Whether you are dealing with tax lien foreclosure, mortgage foreclosure, or real estate tax lien foreclosure, there are steps you can take to save your home. Contacting your mortgage lender, seeking legal advice, and exploring financial solutions are all crucial steps in the process. With the right approach and timely action, you can stop the foreclosure process and secure your financial future.

If you are facing foreclosure, don’t wait until it’s too late to stop foreclosure. Reach out to a law firm for a free consultation, understand your state’s laws, and take proactive steps to protect your home and your financial well-being.

How To Find Private Money Lender With A Private Money Lender Portal?

Navigating the landscape of private financing requires a deep understanding of where to find a “private money lender near me.” This journey can significantly impact your ability to secure funding for investment endeavors, particularly in real estate. Private money lenders, distinct from conventional banking institutions, offer a pathway to funds that might otherwise be inaccessible. This comprehensive guide aims to illuminate the process of finding a private money lender near you, ensuring that your investment projects, whether they are centered on real estate or other ventures, have the financial backing they need to flourish.

Business Loan Types

Equipment Financing Loans

Equipment financing is a type of loan that enables small businesses to purchase the equipment and machinery needed to conduct business and grow their company.

Accounts Receivable Financing

Accounts receivable financing is a type of financing arrangement which is based on a company receiving financing capital in return for a chosen portion of its accounts receivable.

Factoring Financing

Factoring functions similarly to a credit card where the bank or lender (factor) is buying the debt of the customer without recourse to the seller. It is used to get cash quickly.

Merchant Financing

A merchant cash advance is a type of loan financing for small businesses that need capital immediately to cover cash-flow shortages.

Business Line of Credit

A business line of credit is a revolving form of small business funding that operates similar to a credit card that only charges interest on the amount you use of the line of credit.

SBA Loans

SBA loans are guaranteed by the Small Business Administration (SBA) and range from small to large loans which can be used for most business purposes.

Leadership Team Since 1991

Years in Business

Clients

$ Loans

We provide commercial loans for business owners and commercial real estate loans with our private capital. We also have access to 3,000 plus lenders who compete for your business, which allows us to offer you low competitive rates and save time in raising the capital needed for your venture. Our clients are offered loans for Commercial Real Estate Loans, Asset Based Loans, Working Capital Loans, Equipment Lease Loans, Factoring, Trade Financing, Hard Money Loans, Merchant Financing, Small Business Administration Loans (SBA), Structured Financing, Unsecured Lines of Credit.

Stop Foreclosure In Florida

Foreclosure Frequently Asked Questions

-

What is foreclosure?

Foreclosure is the legal process by which a lender takes possession of a property when the borrower fails to make mortgage payments.

-

How does the foreclosure process start?

The foreclosure process begins when a borrower defaults on their mortgage payments, typically after missing several payments, and the lender files a notice of default.

-

Can I stop a foreclosure once it starts?

Yes, there are several ways to stop a foreclosure, including reinstating the loan by paying the overdue amount, negotiating a loan modification, or filing for bankruptcy.

-

What are the different types of foreclosure?

The main types of foreclosure are judicial foreclosure, where the process goes through the courts, and non-judicial foreclosure, which is handled outside of court.

-

How long does the foreclosure process take?

The timeline for foreclosure varies by state and the specific circumstances of the case, but it can take anywhere from a few months to over a year.

-

What happens to my credit score if my home is foreclosed?

A foreclosure can significantly impact your credit score, typically lowering it by 100 to 160 points and remaining on your credit report for seven years.

-

Can I sell my home to avoid foreclosure?

Yes, selling your home before the foreclosure process is completed can help you avoid the negative impact on your credit score and possibly preserve some equity.

-

What is a short sale?

A short sale occurs when the lender allows the homeowner to sell the property for less than the outstanding mortgage balance to avoid foreclosure.

-

Will I owe money after a foreclosure?

This depends on the state and the specific terms of your mortgage. Some states have laws that protect borrowers from owing a deficiency balance, while others allow lenders to pursue the remaining balance.

-

Can I buy another home after a foreclosure?

Yes, but it may take time to rebuild your credit. Lenders typically require a waiting period of three to seven years before approving a new mortgage after a foreclosure.

-

What is a deed in lieu of foreclosure?

A deed in lieu of foreclosure is an agreement where the homeowner voluntarily transfers the property deed to the lender to avoid the foreclosure process.

-

How can I avoid foreclosure?

To avoid foreclosure, communicate with your lender as soon as you anticipate trouble making payments. Options include loan modification, refinancing, forbearance, and financial counseling.

-

Are there government programs to help avoid foreclosure?

Yes, programs such as the Home Affordable Modification Program (HAMP) and the Home Affordable Refinance Program (HARP) have been created to help homeowners avoid foreclosure.

-

What rights do I have during the foreclosure process?

Homeowners have the right to receive notice of the foreclosure, the right to challenge the foreclosure in court, and the right to be treated fairly by the lender throughout the process.

Understanding the Dynamics of Private Money Lending: A Comprehensive Guide

In the complex landscape of real estate investing, individuals often seek alternative financing solutions to fund their projects, and private money lending has emerged as a viable option. Private money loans, offered by private money lenders, have become a crucial resource for many real estate investors looking to secure funding outside traditional financial institutions. This article delves deep into the intricate workings of private money lending, exploring its nuances, benefits, and potential pitfalls.

The Role of Private Money Lenders

Private money lenders play a pivotal role in the real estate investing business. These entities, often individuals or private lending companies, offer private money loans to borrowers for various purposes, such as purchasing investment properties, funding construction projects, or supporting real estate development ventures.

Local Private Money Lender Near Me

Seeking a Private Money Lender Near Me

When embarking on the journey to find a “Private Money Lender Near Me,” real estate investors can employ strategic methods to identify local lenders who understand the nuances of the regional market.

Get Started

Start your new financial journey with Group Capital

Get in touch

Contact US Today

+1 (888) 588-2254

1420 Celebration Blvd, Suite 200, Celebration, FL 34747.